Originally Published at Entrepreneur.com on June 30, 2016

Image credit: Shutterstock

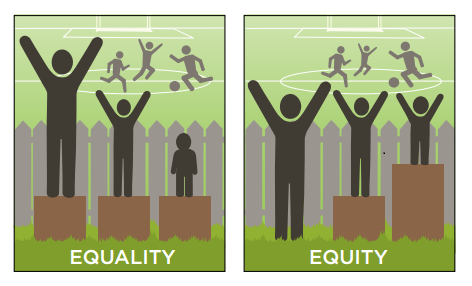

Regulation A+ is the portion of the JOBS Act that allows a company to raise up to $50 million in new capital through an online “Mini-IPO.” It came roaring into the investment world a year ago with the promise of changing the way small businesses get funded. The law allows companies to economically raise funds from the “crowd” and let everyday people, not just the rich and powerful, invest in small private companies for the first time in 80 years. One of the ways Congress and the Securities and Exchange Commission (SEC) made this law affordable was by exempting companies from having to comply with state Blue Sky laws. Those are state by state securities laws that require a company to register and often undergo extensive merit review by each state’s securities regulators.

imagine the legal bills of going to the 50 different states to file extensive paperwork, have a securities regulator review and request changes, then make sure those changes were okay with 49 other state regulators who also were requesting their own changes. This would be a process that took months, cost hundreds of thousands of dollars, and effectively make Regulation A+ unusable.

Kudos for Congress and the SEC for not requiring those burdensome restrictions and creating a law the right way. But despite the seemingly universal appeal of this law, Montana and Massachusetts felt otherwise. Their securities regulators were upset that Congress and the SEC took away their ability to get paid fees from companies they could drag through expensive Blue Sky compliance. They were so upset, they filed a federal lawsuit against the SEC to have Regulation A+ nullified.

Yes, Massachusetts and Montana thought that this game-changing law, destined to help companies raise capital and grow, create new jobs and provide access to investments for the general public, was a bad idea because it did not “protect investors” in their states. "Protect investors" should be read to mean "took away the ability to change money to companies in exchange for putting the company through hell in order to sell securities in their state!"

The good news is, the justice system worked, and the SEC prevailed over the states' attempts to gut the groundbreaking law. In an opinion released June 14, 2016, the United States Court of Appeals for the DC Circuit ruled unanimously that Regulation A+ will stand and continue to provide small companies with the opportunity to raise new capital without Montana, Massachusetts, or any other state being able to force the company to comply with their expensive state Blue Sky laws.

At the heart of the state’s rejected argument was a term used in the law -- “qualified purchaser.” The JOBS Act states that certain Regulation A+ securities may only be sold to a “qualified purchaser” and that the SEC should define that term however it saw fit. The SEC, wanting to be sure that Regulation A+ would allow companies to raise capital as easily as possible, defined the term “qualified purchaser” to mean anyone who wanted to buy the securities. In other words, according to the SEC, a “qualified purchaser” was everybody, not just rich and powerful folks.

Massachusetts and Montana argued that in order to be a “qualified purchaser,” the SEC must limit the people who could purchase Regulation A+ stocks to wealthy people, or must impose some other limitation. That effectively took away the promise of this law that regular people could buy shares of the next Facebook or Google at an early stage in the company's development, when the potential for a greater return on investment would be the highest.

In an extremely well-reasoned opinion, Judge Karen LeCraft Henderson rejected the states' argument and found that Congress had given the SEC the right to define “qualified purchaser” as it saw fit, and that the SEC’s definition was legal, reasonable and in line with the intent of the JOBS Act itself. Final scoreboard: SEC Wins! Small business wins! Everyday investors win! States that wanted to ruin a great law lose!

See, the justice system does work the way it's supposed to... sometimes.

As a result, Regulation A+ lives on. Companies can still use this remarkable law to raise up to $50 million in capital. The Average Joe has a chance to invest a small amount of money in small companies at a stage that was never allowed before. Unless Massachusetts and Montana can convince the United States Supreme Court to hear an appeal, which is very unlikely, the law remains on the books.

The bad news for Massachusetts and Montana is that they can’t drag a Regulation A+ company through their Blue Sky laws and take fees from the company at a stage where the money is most needed to operate and grow. The states will have to find another way to “protect investors” in their state. One thing is for sure: Massachusetts will continue to "protect" their citizens by extracting as much money as possible from them in wonderful investments (note sarcasm) their citizens can benefit from: lottery tickets and blackjack tables.